Class News

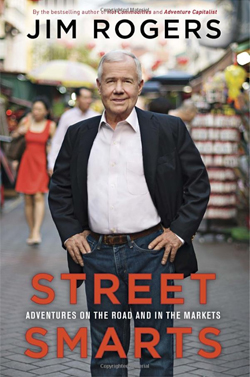

Jim Rogers '64 in USA Today

Nice guys finish last, so eat this brutally honest guy's dust

USA Today

March 12, 2013

So, Jim Rogers, tell us what you really think.

No problem there: Candor is the trademark of this former hedge-fund titan, world traveler, and inveterate memoirist and investor. Rogers is a showman. And his latest book, Street Smarts: Adventures on the Road and in the Markets, exuberantly excoriates the "overconfident incompetents" he believes dominate the U.S. government and Wall Street.

An ungainly pastiche of autobiography, investment advice, and economic rant, Street Smarts is alternately jaunty, rambling, crackpot and entertaining.

Rogers earned his first fortune as co-founder (with George Soros) of the Quantum fund, a wildly successful hedge fund He left at age 37 and traveled twice around the world, via motorcycle and then a custom-made Mercedes, logging hundreds of thousands of miles, scouting out investment opportunities and setting two world records.

During the Mercedes trip, he married his traveling companion — his third wife, Paige, nearly three decades his junior. He has chronicled those adventures already in two memoirs, Investment Biker and Adventure Capitalist, which he doesn't shrink from quoting in Street Smarts.

Like many self-made types, the 70-year-old Rogers exudes an awkward, unsettling aura of arrogance leavened with self-deprecation. His persona is that of a hick savant, albeit an Ivy-educated one. Raised in small-town Alabama, he stumbled his way into Yale, earned a second degree at Oxford, and then headed straight for Wall Street.

There, he fell in love — with the markets; worked fiendishly hard, sacrificing two marriages, and made the mistake (he says) of knowing too much too soon.

He lost money early in his career, he tells us, by shorting stocks that would, indeed, nose-dive, but too late. He eventually did well enough to buy and renovate a 10,000 square-foot mansion on Manhattan's Riverside Drive, where he proudly held annual Mardi Gras parties.

Now invested mostly in commodities and currencies, Rogers says his gift is for spotting long-term trends — from the bursting of the housing bubble (he was again an early Cassandra) to the rise of Asia as an economic superpower. He demonstrated his commitment to that idea by moving his family to Singapore, where he now lives and where his two young daughters have learned Mandarin.

He considered Shanghai and other Chinese cities, he writes, but found them too polluted (arguably the result of the unbridled capitalism that he generally applauds).

It can be hard to pigeonhole Rogers' idiosyncratic views. But for the most part, he comes off as a sort of populist capitalist, with strong libertarian tendencies. He espouses free markets, free trade, and open borders. He disdains the U.S. Patriot Act, the policies of the Federal Reserve, most truces, and the last three U.S. presidents.

He wishes the U.S. Congress would abandon Washington (and its hordes of lobbyists) and meet instead via the Internet. Or that it would disband entirely and be replaced by random ordinary folks doing their civic duty.

Rogers particularly adores bashing figures who have been the objects of mainstream adulation. He calls former Federal Reserve chairman Alan Greenspan "a mediocre Wall Street economist who was perpetually seeking government employment."

An opponent of the bank bailout, he is contemptuous of the bailout's architects, including "know-nothing" Ben Bernanke, chairman of the Federal Reserve; Timothy Geithner (then-chairman of the Federal Reserve Bank of New York), "a man who knew even less than Bernanke"; and President George W. Bush, "who had fewer brains than either of them."

More than his outsized wealth and contempt for those in power, though, it is Rogers' knack for outsized fun that makes him seem worth knowing. Uneven as it is, Street Smarts shines when it conveys that zest.