Class News

Jim Rogers '64, intrepid investor, finds bumpy road to North Korea

The New York Times

March 3, 2017

HONG KONG — China was an economic backwater when Jim Rogers began traveling its dusty byways more than three decades ago. Still, Mr. Rogers, a former partner of George Soros, saw its promise.

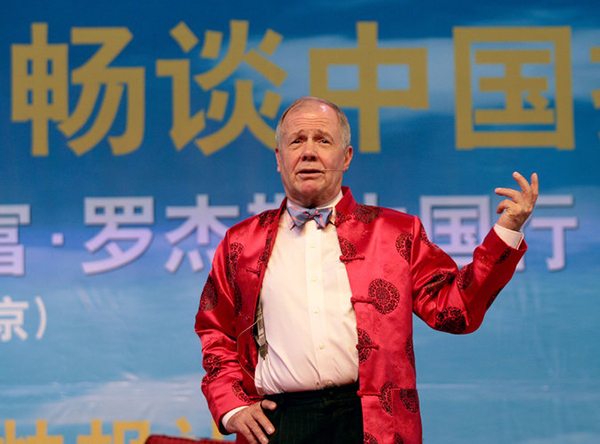

Today, Mr. Rogers, 74, doles out advice to China’s rising investor class at financial seminars, where he often draws a crowd. Part of his message involves another unloved market, where he sees promise despite authoritarian leadership and international sanctions: North Korea.

“It’s very exciting. The kid has been opening up North Korea,” Mr. Rogers said in an interview, referring to Kim Jong-un, the country’s ruler.

But North Korea can be a murky place to tread — as Mr. Rogers’s experience shows.

A Hong Kong company called Unaforte that is involved in several North Korean businesses named Mr. Rogers as a shareholder a year ago, according to a corporate filing. Investing in a North Korean business like that would probably violate American sanctions if it happened now, though experts say it was legal at the time.

Mr. Rogers said he gave Unaforte $100 as a token of good will but never expected that it would name him as a shareholder. Asked about his stake in the company in October, he interrupted an interview with The New York Times to call Unaforte and told the English-speaking sister of its founder that the company had agreed he could not be a shareholder.

Speaking into his phone, Mr. Rogers said, “I know I have told you, ‘Never, never, never.’ ”

Unaforte no longer lists Mr. Rogers as a shareholder in its filings but will not release shareholder records that might show more details about the shares given to Mr. Rogers. Officials at Hong Kong’s corporate registry said they were investigating whether Unaforte is complying with the city’s disclosure laws. Unaforte did not respond to emailed questions for comment.

Investing in North Korea is not for the faint of heart. Many countries heavily restrict what foreign companies and investors can do there. With records in North Korea inaccessible to most outsiders, claims there cannot be easily verified. Intrepid overseas investors have little choice but to work through middlemen, often based in China.

“A lot of times there are these very, very murky series of transactions that need to occur where you may not know who your partners are,” said J. R. Mailey, a visiting scholar at Johns Hopkins’s U.S.-Korea Institute in Washington, who has studied fraudulent investment in North Korea.

Others who saw promise in North Korea have retreated. One firm that counted as an investor a high-profile North Korea bull, James Passin, ended a joint venture there in January because of tightened American sanctions.

Still, for some, the attraction can be considerable. Asia’s fast-growing economies are now well-trodden ground, leaving fewer opportunities to get in early and make it big.

“The country is like an El Dorado that lures people in,” Mr. Mailey said. “They’re willing to risk everything because the payout is so high.”

In interviews, Mr. Rogers said his relationship with Unaforte was distant. He said he spoke at investor events held in mainland China by Unaforte and companies controlled by its founder, Zhao Chunhui, about North Korea, among many other subjects. “I make speeches for hundreds of people,” Mr. Rogers said. He declined to disclose the amount of his speaking fees.

Mr. Zhao appeared to see his relationship with Mr. Rogers differently. In Chinese-language marketing materials and on social media, Mr. Zhao called himself “Jim Rogers’s business partner in China.” A fund promoted at speaking engagements organized by Mr. Zhao or his businesses referred to Mr. Rogers as a shareholder.

The fund and Unaforte posted photos of Mr. Rogers signing and posing with a document titled “shareholder contract” online, announcing in Chinese that Mr. Rogers had become a shareholder. One advertising banner, featuring Mr. Rogers, reads, “Be a shareholder along with Jim Rogers.”

Chinese corporate records show no evidence that Mr. Rogers owns shares in the fund, called Gold Quantum.

Then there was Unaforte’s share allocation to Mr. Rogers. The American investor said he gave Unaforte $100 as a gesture of good will. “It was a token investment once upon a time,” Mr. Rogers said.

Unaforte then made Mr. Rogers a shareholder. According to a Hong Kong filing, it allocated Mr. Rogers shares representing a stake of more than 1 percent in Unaforte.

While the stake is valued at $19,000 on paper, its true value is not clear. On its website, which went offline after The Times began to ask about its businesses, Unaforte said it operated a bank and was building an office park there, and said it owned a stake in a gold mine. Outside of North Korea, the website listed a jewelry-making operation in the Chinese city of Guangzhou, a real-estate investment in Italy, and retail jewelry operations in Hawaii.

The shares were allocated to Mr. Rogers in February 2016, one month before the American government tightened sanctions on North Korea, effectively barring its citizens from any business that might benefit the government there.

“It’s not clear to me that anything Rogers did is illegal,” said Joshua Stanton, a Washington-based lawyer who follows United States sanctions imposed on the country and has helped draft some of them. “It would be now.”

Mr. Rogers said he sent a letter to Unaforte asking that it return his $100 and take back an unspecified number of shares. It was dated March 17, 2016, a day after President Obama signed an executive order imposing new sanctions on North Korea.

A copy of the letter that Mr. Rogers shared with The New York Times was stamped by Hong Kong tax authorities on Sept. 29, the day after The Times first asked Unaforte about Mr. Rogers’s stake in the company. Mr. Rogers said Unaforte told him it delayed getting the stamp because one was required only before the end of the company’s fiscal year, which was Sept. 30.

Mr. Rogers, who does not read Chinese, also said he asked Mr. Zhao to remove mentions of him as a shareholder, and said companies in China and elsewhere often claim falsely to be associated with him. “We have a never-ending battle with things like this all over the world, as do others,” he said in an email.

Mr. Rogers said he was comfortable with other statements by Mr. Zhao’s companies about him. His Chinese-speaking staff members reviewed them, he said, and “my guys are extremely protective of my name.” Mr. Zhao’s companies removed some references to Mr. Rogers following inquiries.

Unaforte is one of a generally quiet group of companies that use China as a jumping-off point to invest in North Korea. Such companies sometimes come under official scrutiny from the United States and China alike.

Its sole director is the 44-year-old Mr. Zhao, who also goes by Willam Zhao.

Documents show Mr. Zhao is a Chinese national but also a citizen of the Dominican Republic. He has identified himself on one of his social-media accounts as the chairman of First Eastern Bank, which is incorporated in the North Korean special economic zone of Rason and which Unaforte says it operates.

Mr. Zhao also has an office in Guangzhou, for the mainland-registered Unaforte company. When visited by a Times reporter last fall, that office featured a poster of Mr. Zhao arm-in-arm with Mr. Rogers.

In an interview, Mr. Rogers said he did not recall how he first met Mr. Zhao. “He seems to be doing a lot in North Korea,” Mr. Rogers said. “He says it’s profitable.”