Class News

Commodities Bull Jim Rogers '64

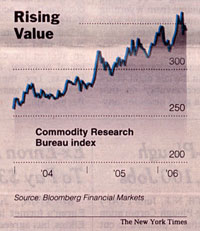

A Commodities Bull Can Find No Reason To Pull In His Horns

James Rogers Sees Recent Declines As Little More Than Temporary Setbacks

New York Times, June 2, 2006

By MICHAEL J. DE LA MERCED (more about Rogers,

and more,

and more)

James B. Rogers Jr. calls himself the world's worst market timer. It is

an air of modesty he cultivates with sometimes folksy anecdotes and an

ever-present drawl.

But market timing aside, as an avowed commodities bull, Mr. Rogers is

undeterred even as less committed bulls suspect that the peak is past.

A fund manager, author, traveler and occasional television commentator, Mr.

Rogers says he believes that the commodities market is less than a decade

through a bull market that could last more than 20 years.

"Someday there will be 10,000 mutual funds that trade commodities," he said.

"On Park Avenue, wives won't talk about flipping real estate. They'll be

talking about soybeans and pork belly futures."

Of those critics who say commodities are only this year's dot-corns, he

says, "Two or three years ago, they couldn't even spell commodities."

By contrast, Mr. Rogers says he has been trading commodities since the early

1970's, even before the commodities boom of that decade.

Jim and Paige with their Millenium Mercedes

in front of a reclining Buddha in Myanmar

He also has a string of unique experiences in the markets. Mr. Rogers

co-founded the Quantum Fund with George Soros in 1969, and retired in 1980

at the age of 37. After a stint at the Columbia Graduate School of Business,

Mr. Rogers embarked on two global adventures, one by motorcycle, detailed in

"Investment Biker," a book he published in 1995, and one in a custom "Millennium

Mercedes" the size and color of Big Bird, the Sesame Street character.

His adventures earned him the sobriquet "the Indiana Jones of finance" from

Time magazine.

More important, he said, those adventures have given him some insight into

the state of various markets around the world, from sweet-toothed

Armani-clad youth in China to corruption-laden bureaucracies in Nigeria.

His faith in a commodities bull run seems ill-timed given the sharp declines

metals have taken after recent spikes. The price of a gold futures contract

for delivery In June, for instance, closed yesterday at $629.60 an ounce on

the Commodity Exchange in New York, down from $728.60 last month.

"We'll always have big consolidations," Mr. Rogers conceded.

Jim in his office in New York

But as crude oil stays stubbornly above $70 a barrel, it's hard to dismiss

him outright.

Though he concedes that energy and metals have hit a rough patch, with zinc

and copper due for a correction, Mr. Rogers Insists that commodities as a

whole will continue to go up.

Look Instead at agricultural products, especially sugar and coffee, he said,

which currently trade far below their historical highs.

Coffee, which traded for more than $3.37 cents at one point in 1977, was

trading at about $1 a pound this week. Sugar, which traded as high as 66

cents a pound in 1974, was trading for about 15 cents a pound this week.

Of course, Mr. Rogers has a stake in promoting that idea. He is the author

of Hot Commodities, a book about commodities investing he wrote in

2004.

And he is the creator of the Diapason Rogers Commodities Index Fund, an

investment fund that buys commodities and is based on the Rogers

International Commodities Index of 35 futures contracts, which Mr. Rogers

also developed. From Jan. 1 through May 31, his commodities index fund rose

9.4 percent. The Standard & Poor's 500-stock index is up 1.7 percent over

the same period.

He points to academic studies that show bull markets lasting anywhere from

15 to 23 years; given those figures, the commodities bull run that started

in 1999 should last until 2022. And more important, he says, commodities

producers have failed to develop new sources of production.

Demand for lead has exploded, but the last new smelter built in the United

States was opened in 1969. 0il companies have not opened significant new oil

fields in more than 25 years. The story is the same with copper.

With a python

"I was with a couple of copper mining CEOs recently, and they said they were

having a hard time finding labor, saying, ‘We can't find engineers, we can't

even find miners,'" Mr. Rogers said. "And I asked them if they even know the

level of their reserves. And no one knew."

Couple that with voracious appetites for commodities in China and India, and

the prices should continue to climb, he said.

"The last time we had a bull market, three billion people in Asia were

closed off," Mr. Rogers said. "Now we have China, we have India looking for

commodities. They've all seen Western TV."

Mr. Rogers has great faith in China as the bull to which the commodities

market is yoked. He says he believes that China will fully float its

currency, the yuan, in time for the 2008 Summer Olympics in Beijing, and

that China's growing capitalist class will displace the Communist Party.

Mr. Rogers is bearish on the United States. To him, America's time has

passed, with its $8.36 trillion in debt, a weak dollar and its dependence on

imported oil. He recommends selling United States dollars.

He recommends investing in countries with well-managed commodities

production, like Canada, Brazil and Argentina, as well as China.

Mr. Rogers believes in China so much that he hired a nanny who speaks only

Mandarin to his 3-year-old daughter. Signs taped around the Rogers household

name objects in English and in Mandarin: a panda statue bears one with the

characters for "xiong mao." Hanging above the stainless steel stove is the

word "zhao."

His wife, Paige Parker, who was his traveling partner in the Mercedes during

the "Adventure Capitalist" journey, is learning Mandarin this summer. Mr.

Rogers said he might try to pick it up, but he has few illusions about his

chances for success. "I'm tone deaf," he said.